The FIRE movement—Financial Independence, Retire Early—has exploded.

It’s got blogs, subreddits, meetups, gurus, even merch.

Some people treat it like personal finance.

Others? Like religion.

So here’s the question we’re digging into:

Is FIRE a smart way to reclaim your time—or is it a cult wrapped in spreadsheets?

Let’s investigate—clear-eyed, no hype, no hate.

🔥 What FIRE Actually Means

At its core, FIRE is about one thing:

Buying back your freedom.

How?

- Spend less

- Save more

- Invest the gap

- Reach a point where you never have to work again

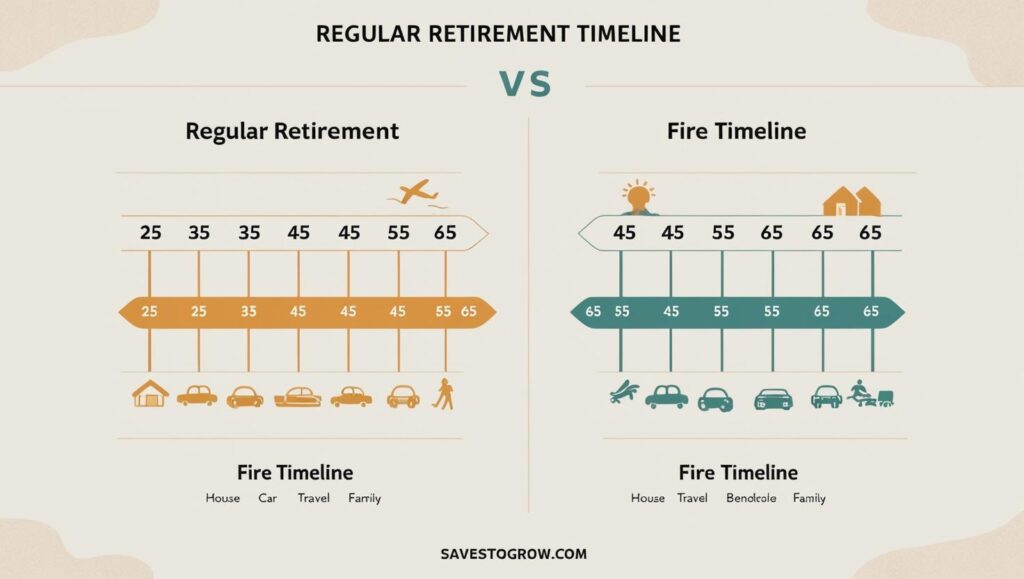

FIRE folks aim to retire not at 65—but at 45, 40, even 30.

Sounds great, right?

But critics say it goes too far.

😬 The Cult Accusations: Where They Come From

Here’s why FIRE gets side-eyed:

1. Dogmatic Minimalism

Some FIRE influencers push an extreme version:

- No restaurants

- No vacations

- No car

- No hobbies that cost money

“If it doesn’t earn or save you money, it’s a waste.”

That’s not freedom—that’s financial monasticism.

2. Us vs Them Mentality

The FIRE community often sees the rest of the world as financially irresponsible sheep.

That creates echo chambers—and ego.

3. Guru Worship & Buzzwords

Some figures are treated like prophets.

Terms like “lean FIRE,” “barista FIRE,” and “fat FIRE” start sounding like insider jargon more than practical advice.

✅ But Here’s What FIRE Gets Right

Strip away the dogma, and the core philosophy is powerful:

- Financial literacy: Most people are never taught how to save, invest, or plan. FIRE fixes that.

- Delayed gratification: FIRE trains you to play the long game, not chase quick dopamine.

- Time as currency: You stop trading your hours for someone else’s dream.

Even if you never retire early, just learning how to live below your means and invest wisely is life-changing.

🤯 Thought Experiment: What If FIRE Is a Cult?

Then ask yourself—

Is it a cult that helps you escape the cult of consumerism?

Because here’s what most people never question:

- Buying things they don’t need

- Working jobs they hate

- Taking on debt to impress strangers

- Retiring when their body is breaking down

Maybe FIRE seems extreme because normal is broken.

🧠 A Personal Note

I don’t follow FIRE like gospel.

I eat out. I travel. I enjoy my life now.

But learning FIRE principles?

That was my wake-up call.

It made me realize that money = freedom.

And freedom isn’t just about retiring early.

It’s about working because you want to—not because you have to.

📚 FAQs

Q: Do you have to be ultra-frugal to follow FIRE?

Not at all. There’s a spectrum. Many people follow “Coast FIRE” or “Slow FIRE” that allows for balance.

Q: Is FIRE only for high earners?

No. It helps anyone make smarter financial decisions, even on modest incomes.

Q: What’s the biggest mistake new FIRE followers make?

Getting obsessed with the number and sacrificing their present life completely. Balance matters.