Do You Feel Poor—Even With a Decent Income?

You make okay money. Bills are paid. You’re not drowning in debt.

And yet… you feel broke. All. The. Time.

This isn’t just in your head.

It’s called money dysmorphia—and it’s becoming a silent epidemic.

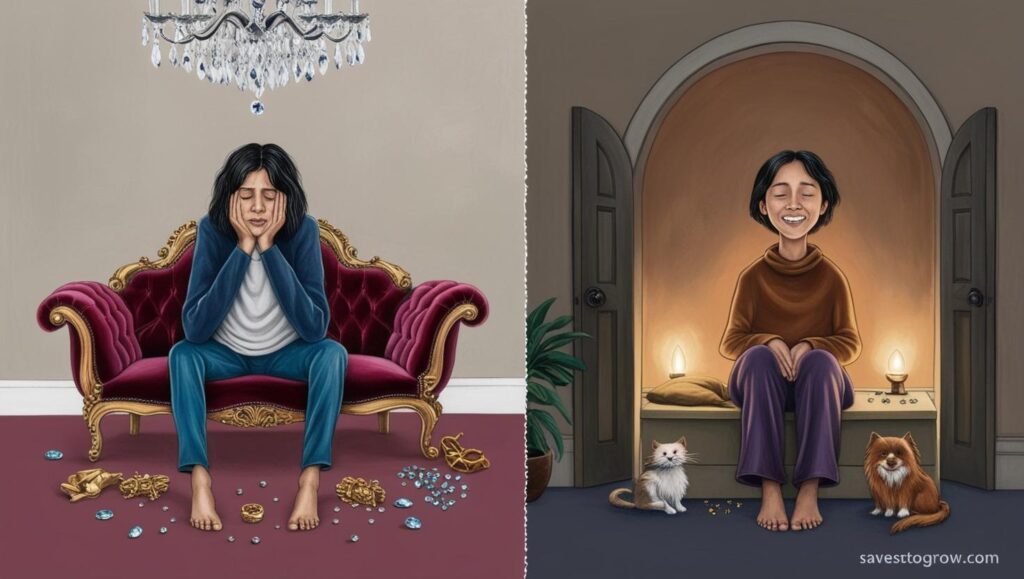

Just like body dysmorphia makes people obsess over flaws that aren’t really there, money dysmorphia skews how you see your financial reality. You think you’re worse off than you actually are.

Let’s break down:

- What causes it

- How to spot it

- And how to fix it—for good.

What Is Money Dysmorphia?

Money dysmorphia is a distorted perception of your financial status. You might:

- Feel poor even when you’re saving or earning above average

- Constantly compare yourself to others

- Think you’re behind, even if you’re on track

It’s not about your actual net worth. It’s about your emotional relationship with money.

The 5 Hidden Causes of Money Dysmorphia

1. Lifestyle Inflation (You Normalize What Should Feel Rich)

When you upgrade your lifestyle with every raise, the “new normal” erases your progress.

- $80k used to feel rich. Now it feels tight. Why?

- Because your spending grew with your income.

Fix: Lock in your lifestyle for 1–2 years after every income jump. Let the gap build wealth.

2. Endless Social Comparison

Instagram shows your high school friend in Dubai. Your co-worker just got a Tesla. Suddenly, you feel behind.

But you don’t see the credit card debt behind the scenes.

Fix: Unfollow “flex culture.” Follow people who post savings, simplicity, and freedom, not yachts and watches.

3. Financial Trauma or Scarcity Mindset

If you grew up with unstable finances, your brain wires itself for fear—even after your situation improves.

You could have $20K in savings and still feel on the edge.

Fix: Recognize your trauma patterns. Therapy helps. So does building systems that prove you’re safe (like 6-month emergency funds).

4. Lack of Visibility (No System = No Confidence)

If you don’t track your money, your brain fills in the blanks—with fear.

- “I think I have enough…”

- “Pretty sure rent will clear…”

- This uncertainty fuels the broke feeling.

Fix: Use a simple money dashboard. Know your numbers weekly. Clarity kills anxiety.

5. Your Goals Keep Moving

You wanted to hit $10K saved. You did it.

Then you wanted $50K.

Then $100K.

Now it’s $1M.

You’re not broke—you’re chasing a horizon that keeps running away.

Fix: Celebrate financial wins. Sit in them. Gratitude is a financial strategy, not just a mindset.

How to Reset Your Money Perception (In 5 Steps)

✅ 1. Audit Your Money Story

Ask yourself:

- What did I learn about money growing up?

- Do I associate having money with guilt, fear, or unworthiness?

Write it out. Then question every belief. You’re allowed to outgrow financial survival mode.

✅ 2. Track Net Worth Monthly

Even if you have debt, tracking shows progress.

Watch your net worth inch upward—even slowly.

Progress rewires perception. No spreadsheet = emotional chaos.

✅ 3. Make Your Own Definition of “Wealthy”

Is it $10M? Or is it:

- No debt

- Time freedom

- Not worrying about the next bill?

Write your personal wealth metric. It will anchor you against outside noise.

✅ 4. Pause Spending for a 7-Day Reset

Try buying nothing but essentials for 7 days. Not to punish yourself—just to observe.

You’ll see:

- How often spending is emotional

- What truly satisfies vs. distracts

This gives your brain evidence: I’m not broke. I just had no filter.

✅ 5. Practice “I’m Already Rich If…” Mindset

Finish this sentence daily:

“I’m already rich if I have _____.”

Family? Health? Freedom to work remotely?

You’ll find your “broke” story fading fast.

My Personal Wake-Up Call

There was a time I felt poor—even while earning 6 figures.

I had savings. No debt. A paid-off car. Still felt anxious every time I swiped my card.

Turns out I wasn’t broke.

I was addicted to the feeling of being behind.

Social media, hustle culture, and my own internal narrative were keeping me trapped.

Now? I still track every dollar. But I also track peace of mind.

FAQ

Q: Is money dysmorphia a real condition?

It’s not officially in the DSM, but psychologists recognize it as a real pattern of distorted financial perception.

Q: Can you have money dysmorphia if you’re actually in debt?

Yes. Even when money is tight, dysmorphia can make it feel worse than it is—which leads to shame and avoidance.

Q: How long does it take to change your money mindset?

Give it 60–90 days of consistent awareness, tracking, and gratitude. It’s not overnight—but the shift is real.

Q: Should I stop trying to grow my income?

No—just don’t tie your sense of worth to it. Growth is great. But so is feeling enough, right now.