Tap, Pay, Forget

It all started with a ₹79 coffee I didn’t need. I tapped my phone, smiled at the barista, and walked out. Ten minutes later, I couldn’t even remember the transaction.

That’s when it hit me: UPI had made spending frictionless—too frictionless. And frictionless spending is dangerous.

So, I set a radical challenge for myself: 30 days. No UPI. No cards. Cash only.

Here’s how that experiment rewired my brain and reshaped my relationship with money.

Why Go Cash-Only in a UPI World?

UPI is a marvel. But like any powerful tool, it has a dark side:

- Zero tactile connection to money

- No visual cue of “spending”

- Micro-transactions pile up invisibly

- You spend before thinking

Cash, on the other hand, makes you pause. Feel. Rethink.

That’s exactly what I needed.

Rules of the Challenge

- No UPI, no debit/credit cards, no wallets.

- ₹5,000 withdrawn at the start of each week.

- All payments—from chai to groceries—must be physical cash.

- If I forget cash, I go without.

Week 1: The Slap of Reality

Day 1, I left my wallet at home. My usual chai stop? Skipped.

At the vegetable vendor, I had to put items back after realizing I was ₹20 short.

The embarrassment stung. But something inside me clicked:

Cash forces you to do math before you pay. UPI lets you pay before you think.

Week 2: The Shift Begins

This week, I:

- Stopped ordering food delivery (too many digital-only restaurants)

- Packed snacks from home

- Bargained again at local shops (they appreciated cash!)

- Bought only what fit in my wallet

I even skipped a ₹300 online impulse buy because it wasn’t “cashworthy.”

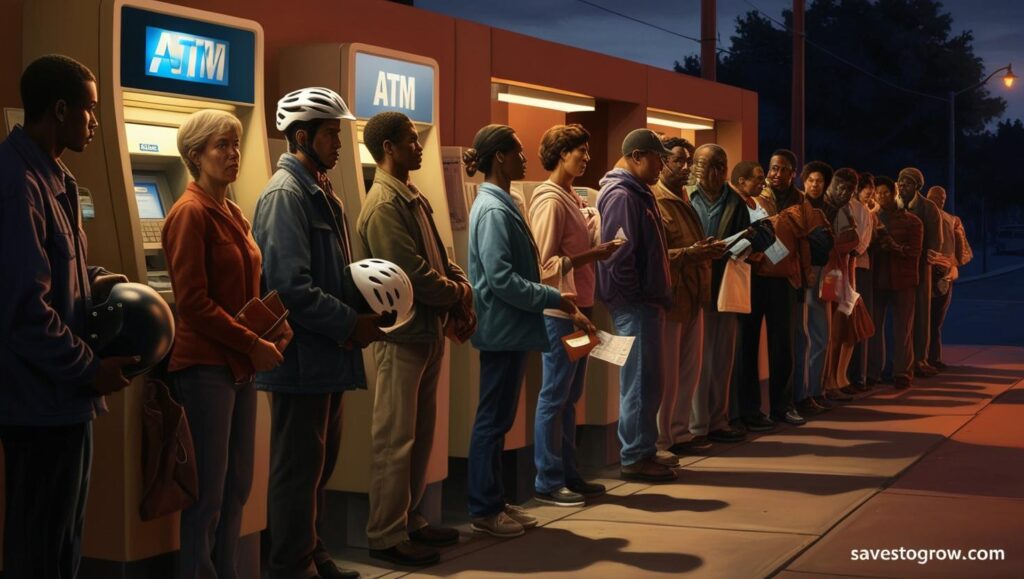

Week 3: Identity Crisis in an ATM Queue

There I was, standing at an ATM at 9 PM. A 20-minute wait for ₹2,000.

And I realized: The ease of spending was never the real problem—it was the ease of access.

Having to work to access cash made every rupee feel earned.

The result? My weekend spending dropped by 40%.

Week 4: Financial Clarity Kicks In

I began tracking every expense in a tiny pocket notebook.

| Category | Spent (₹) | Previously (₹) |

|---|---|---|

| Food | 1,400 | 3,200 |

| Commute | 650 | 1,100 |

| Snacks | 220 | 750 |

| Random Stuff | 0 | 1,500+ |

Cash turned invisible expenses into visible patterns.

I learned to say “no” without guilt. Because cash made me ask myself:

Do I really want to spend ₹500 on this?

Unexpected Wins

- Got friendlier with local vendors (many offered cash discounts)

- Stopped doom-scrolling Swiggy and Zomato

- Felt mentally lighter—spending less felt empowering

Also, I reconnected with delayed gratification. Something UPI had slowly stolen.

The Comeback: Reintroducing UPI… With Rules

After 30 days, I went back to UPI—but not blindly.

Now I follow these 3 rules:

- Use UPI for essentials only (groceries, bills)

- Withdraw ₹2,000 cash/week for personal use

- Pause before paying—2-second rule: Do I need this?

Key Takeaways

- Cash makes you think. UPI makes you forget.

- Spending isn’t just math—it’s emotion, memory, and intention.

- A temporary cash-only experiment can reboot your brain’s financial wiring.

- You don’t need to quit UPI. Just don’t let it run your life.

FAQs

Q: Isn’t carrying cash risky?

A: Keep amounts small. ₹1,000–₹2,000 max. Risk is lower than losing control digitally.

Q: What about online bills and subscriptions?

A: Set those on auto-debit. Focus the cash experiment on discretionary spending.

Q: Did you miss UPI convenience?

A: Yes, but the clarity I gained outweighed the inconvenience.

Q: Is this feasible for everyone?

A: It’s easier for freelancers, students, or anyone who can segment daily spends. Office-goers may need hybrid solutions.

Q: Will you do it again?

A: Absolutely. Maybe every quarter as a “Spending Reset.”