Think Tetris is just a retro time-killer?

Think again.

Behind those falling blocks lies a blueprint for financial mastery—one that top investors, entrepreneurs, and savvy savers unconsciously follow.

Let’s break down how the game that shaped our childhood can shape your bank account.

The Core Idea: Pattern Recognition = Wealth Acceleration

In Tetris, you succeed by:

- Recognizing patterns quickly

- Making fast, efficient decisions

- Avoiding clutter (literally and mentally)

Sound familiar?

That’s exactly how smart people build and protect wealth.

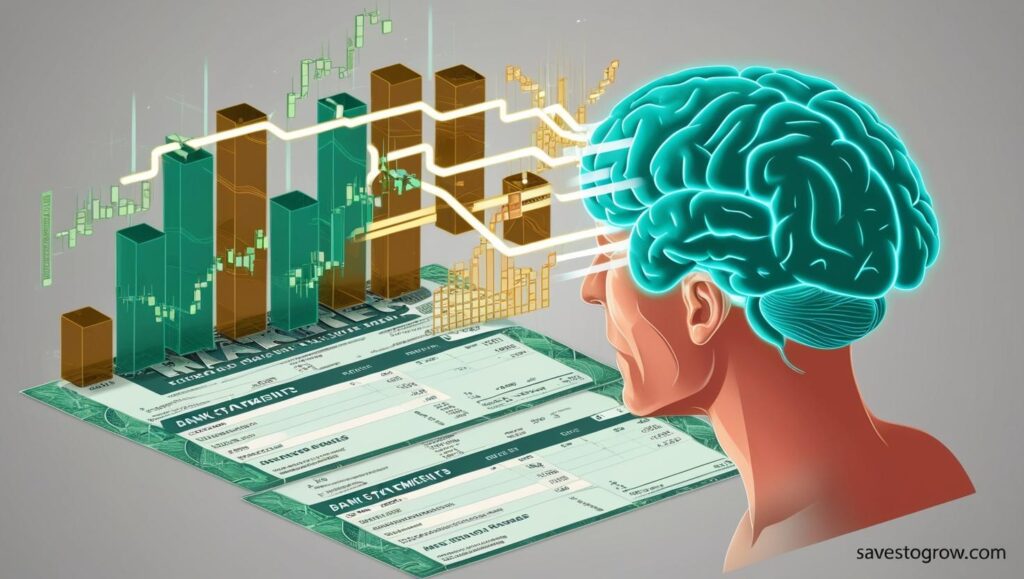

1. Spotting Patterns in Chaos

Tetris teaches your brain to see order in noise—and that’s the #1 skill in finance.

🔍 Example in money:

- Seeing recurring expenses and cutting them

- Spotting when stocks are undervalued

- Noticing when you’re falling into lifestyle inflation

💡 The wealthy don’t work harder. They see better.

2. Making Fast, Informed Decisions

In Tetris, hesitation kills. Same with money.

💸 Financial translation:

- You don’t “think about” investing forever—you automate and start

- You don’t hoard cash—you allocate it strategically

- You don’t overanalyze—you move with purpose

✅ Smart money moves are rarely perfect. But they’re made on time.

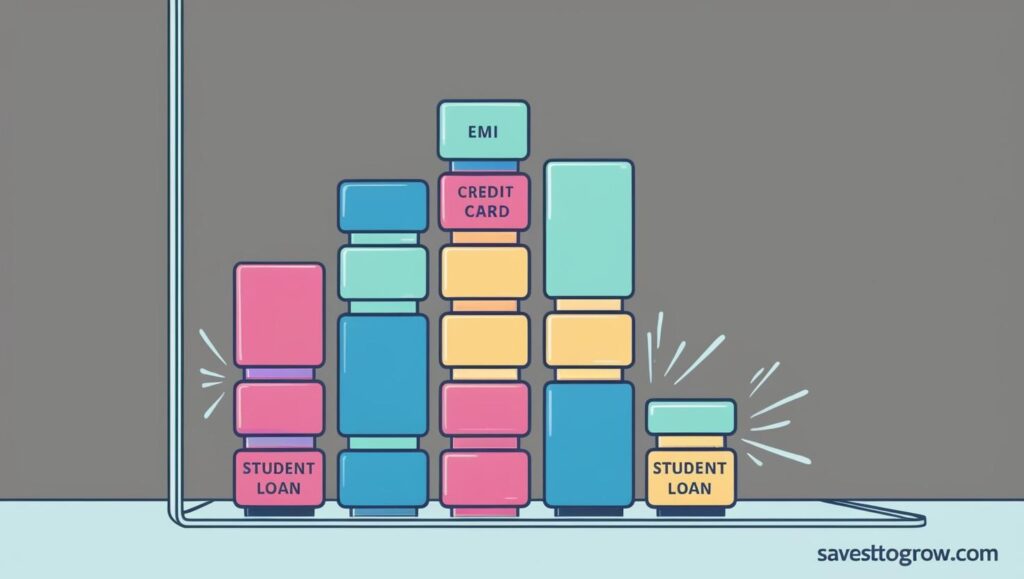

3. Clearing Mental Clutter = Better Spending

Every block in Tetris has a cost. Let one stack go unchecked? You’re overwhelmed.

Same goes for:

- Credit card debt

- Random subscriptions

- Overbuying in the name of “treating yourself”

📉 Mental clutter = financial clutter. You need to clear lines before chasing more.

4. Think Long-Term, Act Short-Term

In Tetris, you build for the Tetris line clear—but place every block with short-term precision.

💰 In finance:

- You have long-term goals (retirement, freedom, house)

- But daily actions (spend less than you earn, invest monthly, learn consistently) are how you get there

🏆 Every financial win is just the result of stacked micro-decisions.

5. Learn From Losses. Play Again.

Lose a game of Tetris? You don’t cry—you restart.

That’s the exact mindset required for:

- Recovering from investment mistakes

- Bouncing back from bad purchases

- Rebuilding after a bad financial year

🧠 The resilient mindset Tetris teaches = priceless.

How I Applied This in Real Life

Once I saw the parallel, I changed my financial habits:

- Created a monthly budget like a Tetris board—every block had to fit

- Used YNAB app to categorize income with precision

- Played “debt Tetris” by knocking out one high-interest loan at a time

- Treated every saved rupee like a perfectly placed block toward freedom

Results? In 11 months, I went from stressed about money to investing confidently.

This Isn’t Just Philosophy. It’s Neuroscience.

Studies show Tetris improves:

- Spatial pattern recognition

- Decision speed under pressure

- Impulse control

All critical skills for making smarter financial decisions.

Source: [Nature Neuroscience, 2022]

FAQs

Q: Can a game really change your financial life?

Not by itself. But the mindset it builds can be weaponized for real-world decision-making.

Q: How do I start applying this?

Start small. Track patterns in your spending. Visualize your budget like a Tetris grid. Focus on clearing clutter.

Q: What’s the best app to use this method?

Apps like YNAB, PocketSmith, and Notion are great for visual budgeting and stack-style goal setting.